Securing a Home Loan Process is a crucial step in the journey to homeownership. This process involves several stages, each designed to ensure that both the lender and borrower are adequately prepared for the financial commitment involved. Understanding the home loan process can help you navigate it more effectively and increase your chances of securing favourable terms. This guide will walk you through the essential steps, from determining your budget to closing on your new home. By familiarizing yourself with these steps, you can make informed decisions and avoid common pitfalls.

Home Loan Process, Home Buying, Mortgage Lender, Preapproval, Home Appraisal, Home Inspection, Closing Costs, Down payment, mortgage underwriting, real estate agent.

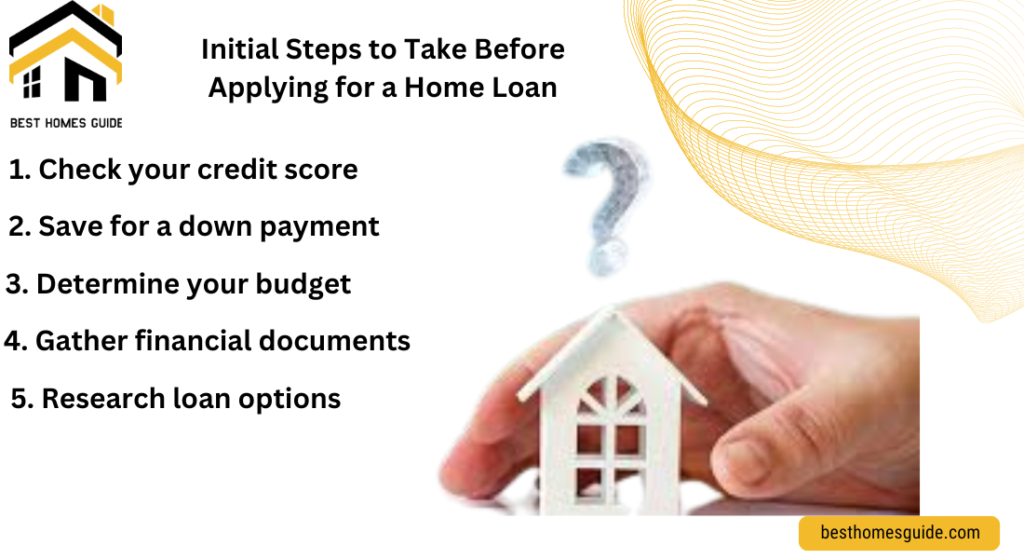

Initial Steps to Take Before Applying for a Home Loan

1. Assess Your Financial Health

Before you begin the home loan process, it’s crucial to evaluate your financial situation. Start by reviewing your credit report and score, as lenders will use this information to determine your creditworthiness. Regularly monitoring your credit report allows you to identify and address any inaccuracies or issues that could negatively impact your loan application. Aim for a good credit score to secure better loan terms (The Mortgage Reports) (TransUnion).

Calculate your debt-to-income (DTI) ratio, which is a key factor that lenders consider. This ratio compares your monthly debt payments to your monthly gross income. Ideally, your DTI should be below 50% to increase your chances of approval for a conventional mortgage (Quicken Loans).

2. Determine Your Budget and Savings

Understanding how much house you can afford is essential before applying for a home loan. Use a home affordability calculator to estimate a realistic budget, considering your income, debts, and savings. Ensure you have enough savings for a down payment, which typically ranges from 3% to 20% of the home’s purchase price, depending on the loan type (Refinance Or Apply For A Mortgage Online) (Quicken Loans).

In addition to the down payment, prepare for other upfront costs such as closing costs, which usually range from 2% to 6% of the loan amount. Setting aside funds for these expenses will prevent financial strain during the Home Loan Process (TransUnion).

3. Research and Compare Lenders

Before applying for a mortgage, take the time to research and compare different lenders. Look at the various Home Loan Process options, interest rates, fees, and customer reviews to find a lender that best suits your needs. Each lender may offer different loan programs, such as FHA, VA, or conventional loans, each with its own benefits and requirements (Refinance Or Apply For A Mortgage Online) (Quicken Loans).

Comparing lenders will help you understand the full scope of available mortgage products and identify any homebuyer assistance programs you might qualify for. These programs can provide benefits such as down payment assistance or reduced interest rates, making home ownership more affordable (The Mortgage Reports) (TransUnion).

By taking these initial steps, you can ensure that you are well-prepared and informed as you embark on the home loan process. This preparation will increase your chances of securing a favorable mortgage and help you avoid common pitfalls along the way.

Importance of Getting Preapproved for a Mortgage

1. Understanding Your Budget

Getting preapproved for a mortgage is crucial because it helps you understand how much house you can afford. During the preapproval Home Loan Process, lenders review your financial documents, such as income statements, credit reports, and asset documentation, to determine the loan amount you qualify for. This gives you a clear picture of your budget and prevents you from looking at homes outside your price range. It’s a proactive step that helps streamline your home search and ensures you’re financially prepared for the commitment (Refinance Or Apply For A Mortgage Online) (LendingTree).

2. Strengthening Your Offer

A mortgage preapproval letter demonstrates to sellers that you are a serious buyer with the financial backing to purchase their home. In competitive housing markets, having a preapproval can make your offer more attractive compared to those without it. Sellers are more likely to choose a buyer who has been preapproved because it reduces the risk of financing falling through at the last minute. This can be a significant advantage, especially when multiple offers are on the table (Zillow) (PenFed).

3. Faster Closing Process

Since much of the financial vetting is done during the preapproval stage, getting preapproved can speed up the closing Home Loan Process once you find a home. The lender already has your financial information on file, which means less paperwork and fewer delays in finalizing the loan. This can be particularly beneficial if you need to move quickly due to personal or market conditions. Being preapproved not only expedites the home-buying process but also provides peace of mind knowing that you have already cleared a significant hurdle (Refinance Or Apply For A Mortgage Online) (LendingTree).

What Documents Are Needed for Mortgage Preapproval?

1. Proof of Income

To get preapproved for a mortgage, you’ll need to provide various documents that verify your income. This includes at least two years of personal income tax returns, your most recent pay stubs, W-2 statements, and 1099 forms if you’re self-employed. Additionally, if you receive income from other sources like alimony, child support, or disability payments, you’ll need to provide documentation for those as well. This comprehensive overview helps lenders assess your ability to repay the loan (Refinance Or Apply For A Mortgage Online) (LendingTree).

2. Employment Verification

Lenders require proof of stable employment to ensure you have a reliable income stream. You’ll need to provide the name, address, and contact information of your current employer, as well as details about your position and salary. If you’ve been with your current employer for less than two years, you may also need to provide similar information about previous employers. This helps establish a consistent employment history, which is a critical factor in the preapproval Home Loan Process.

3. Proof of Assets and Liabilities

Lenders will ask for recent bank statements, retirement account statements, and documentation of other assets like stocks or real estate. They’ll also require information on any liabilities you have, such as credit card debt, car loans, or student loans. This information is used to calculate your debt-to-income ratio, which helps determine how much you can borrow. Having all these documents ready can streamline the preapproval process and provide a clear picture of your financial health.

How to Choose a Mortgage Lender

1. Compare Rates and Fees

When selecting a mortgage lender, it’s important to compare the interest rates and fees associated with different lenders. Each lender may offer varying rates and charge different fees for origination, processing, and closing. Shopping around allows you to find the best deal that fits your financial situation. Look for lenders that offer competitive rates and transparent fee structures to avoid any hidden costs (Refinance Or Apply For A Mortgage Online) (TransUnion).

2. Assess Customer Service and Reputation

The quality of customer service and the reputation of the lender are also crucial factors to consider. Read reviews and ask for recommendations from friends and family to gauge the experiences of other borrowers. A lender with good customer service will be more responsive and helpful throughout the mortgage process, making it smoother and less stressful. Positive feedback and a solid reputation can indicate that the lender is trustworthy and efficient.

3. Explore Loan Options

Different lenders may offer a variety of loan products, such as conventional loans, FHA loans, VA loans, and USDA loans. Each of these has specific eligibility requirements and benefits. For instance, VA loans offer favourable terms for veterans, while FHA loans are designed for borrowers with lower credit scores. Understanding the loan options available from each lender can help you choose one that best meets your needs and financial goals.

By carefully considering these factors, you can select a mortgage lender that provides the best combination of rates, services, and loan options, ensuring a smooth and successful home buying experience.

Steps Involved in Finding and Making an Offer on a Home

1. Finding the Right Home

The first step in the home buying process is finding a property that meets your needs and budget. Begin by researching the local real estate market to understand current trends and property values. Use online real estate portals like Zillow or Realtor.com to browse listings and attend open houses to get a feel for what’s available. Working with a real estate agent can be incredibly beneficial; they have access to listings that may not be available to the public and can offer valuable insights into neighbourhoods and market conditions (Refinance Or Apply For A Mortgage Online) (Realtor).

2. Making an Offer

Once you find a home that meets your criteria, the next step is making an offer. Your real estate agent will help you determine a fair offer price based on a Comparative Market Analysis (CMA) and guide you through the necessary paperwork. The offer will include the sale price, terms of the sale, contingencies such as financing and home inspection, and the proposed closing date. Including a strong earnest money deposit can make your offer more attractive to sellers.

3. Negotiating and Finalizing the Offer

After submitting your offer, the seller can accept, reject, or counter it. If a counteroffer is made, your agent will negotiate on your behalf to reach mutually agreeable terms. This can involve adjusting the price, changing the closing date, or addressing any contingencies. Once both parties agree, a purchase agreement is signed, and the home moves into escrow, where final preparations for closing begin.

Role of a Real Estate Agent in the Home Buying Process

1. Expert Guidance and Market Knowledge

A real estate agent plays a crucial role in the home buying process by providing expert guidance and in-depth market knowledge. They help buyers understand current market conditions, evaluate properties, and make informed decisions. An agent’s experience in the local market can be invaluable in identifying potential red flags in a property and advising on the best neighbourhoods and investment opportunities.

2. Handling Paperwork and Negotiations

Real estate transactions involve a significant amount of paperwork and legal documents. An agent ensures that all necessary paperwork is completed accurately and submitted on time. They also handle negotiations with the seller’s agent to secure the best possible terms for the buyer. This includes negotiating the sale price, contingencies, and closing costs. Their negotiation skills can save buyers money and help avoid potential pitfalls.

3. Connecting with Other Professionals

A buyer’s agent has a network of professionals, including mortgage brokers, home inspectors, and real estate attorneys, that they can recommend to their clients. These connections can streamline the buying process and ensure that each step is handled by a trusted expert. Additionally, agents coordinate the various services required to complete the transaction, such as appraisals, inspections, and title searches.

How to Prepare for Your Down Payment and Closing Costs

1. Saving for a Down Payment

The down payment is a crucial component of buying a home, typically ranging from 3% to 20% of the purchase price. Saving for a down payment requires planning and discipline. Start by setting a savings goal based on the price range of homes you are considering. Utilize savings accounts or investment options that offer a good return without risking your principal. Automating your savings can help you consistently set aside money towards your goal.

2. Understanding Closing Costs

The down payment, buyers must be prepared for closing costs, which usually range from 2% to 6% of the loan amount. These costs include fees for the appraisal, home inspection, title search, and loan origination. Lenders are required to provide a Loan Estimate, which outlines these costs, early in the application process. Review this estimate carefully to understand all the fees involved and ensure you have sufficient funds set aside.

3. Reducing Upfront Costs

To reduce upfront costs, consider negotiating with the seller to cover part of the closing costs or look for lender programs that offer closing cost assistance. Additionally, some government programs and grants are available to first-time homebuyers that can help with down payment and closing costs. Explore all your options to minimize the amount you need to bring to the closing table.

What are the essential steps to secure a home loan?

In conclusion, securing a home loan is a significant financial commitment that requires careful consideration and thorough preparation. The loan process typically involves several critical steps, including determining your financial readiness, shopping for the best loan options, applying for the loan, and undergoing underwriting before finally closing the deal.

It is essential to understand each phase of the process to make informed decisions that align with your financial goals. Proper research and planning can help you secure the most favourable terms, ensuring that your mortgage is manageable and suited to your long-term plans. By staying informed and proactive, you can navigate the home loan process effectively, ultimately achieving the dream of homeownership in a sustainable and financially sound manner.

how can you ensure you are financially prepared for each phase?

Key points to remember:

Include maintaining a good credit score, saving for a down payment, and considering all costs associated with the loan. working closely with a trusted lender and real estate professionals can provide valuable guidance and support throughout the journey. Remember, the home loan process is not just about obtaining financing; it’s about building a foundation for your future.