Buying a house involves various financial considerations, and one of the most significant is understanding closing costs. These costs can come as a surprise to many first-time homebuyers, but being well-informed can help your budget effectively and avoid any last-minute financial stress. Closing costs are fees and expenses required to finalize your mortgage, and they typically range from 2% to 6% of the loan amount. In this article, we’ll explore the different components of closing costs, how they are calculated, and what you can do to manage them.

Closing costs encompass a variety of fees for services and expenses necessary to complete the purchase of a home. These costs are not just limited to the buyer; sellers also have closing costs to pay. what these costs include and how they are determined will help you navigate the home buying process with greater confidence. Whether you are buying your first home or your next investment property, knowing how to estimate and manage closing costs is crucial to making a sound financial decision.

Table of Contents

What Are Closing Costs in a Real Estate, Transaction?

Closing costs are fees and expenses that both buyers and sellers incur during the finalization of a real estate transaction. These costs cover a wide range of services required to transfer property ownership and secure a mortgage. They typically include lender fees, third-party fees, and prepaid items, all of which are necessary to complete the transaction.

Lender Fees: These are charges from the lender for originating and processing the mortgage. Common lender fees include the loan origination fee, which is a percentage of the loan amount, and the underwriting fee, which covers the cost of evaluating your loan application. Other lender fees can include application fees, document preparation fees, and credit report fees.

Third-Party Fees: These fees are paid to third parties involved in the transaction, such as appraisers, home inspectors, and title companies. For example, an appraisal fee covers the cost of assessing the home’s market value, while a title search fee ensures the property is free from liens or other legal issues. Additional third-party fees might include pest inspection fees, survey fees, and attorney fees if a lawyer is involved in the transaction.

Prepaid Items: These are upfront payments for recurring costs associated with homeownership, such as property taxes, homeowners insurance, and mortgage interest. Prepaid items are collected at closing to ensure these expenses are covered during the initial period of homeownership. For instance, you might need to pay several months’ worth of property taxes and insurance premiums into an escrow account managed by your lender.

What Are the Different Types of Closing Costs?

Closing costs are three types: Lender fees, Third-party Fees, and Prepaid items. Each type will help you anticipate and budget for these expenses more effectively.

Lender Fees:

These fees are charged by the mortgage lender for processing your loan. Common lender fees include:

- Loan Origination Fee: Lender Fees covers the lender’s costs for creating and processing your mortgage and is typically 0-1% of the loan amount.

- Underwriting Fee: This fee pays for the lender’s evaluation of your loan application and financial information to determine your eligibility.

- Application Fee: Some lenders charge an upfront fee for processing your mortgage application, which can range from $200 to $500.

Third-Party Fees:

These are fees paid to non-lender parties involved in the home buying process, such as:

- Appraisal Fee: This fee, usually between $500 and $1,000, pays for a professional appraiser to assess the home’s market value.

- Title Search and Insurance Fees: These fees cover the cost of verifying the property’s legal ownership and protecting against future claims. Title insurance can range from $300 to $2,500.

- Home Inspection Fee: An inspection fee, typically between $300 and $500, covers the cost of a professional home inspection to identify any potential issues with the property

Prepaid Items:

These are upfront payments for ongoing costs associated with homeownership, including:

- Property Taxes: You may need to pay a portion of your annual property taxes at closing, depending on the time of year and local tax billing practices.

- Homeowners Insurance: Lenders often require the first year’s insurance premium to be paid at closing, which can range from $400 to $1,000.

- Mortgage Interest: Depending on your closing date, you may need to prepay interest from the closing date to the end of the month.

How Much Can You Expect to Pay in Closing Costs?

The amount you can expect to pay in closing costs varies depending on the price of the home, the loan amount, and the specific fees required in your area. On average, closing costs range from 2% to 6% of the loan amount, meaning for a $300,000 home, you could pay between $6,000 and $18,000.

Average Costs: According to recent data, the national average for closing costs is approximately $6,905, including transfer taxes. These costs can vary widely based on location and property value. For example, the highest closing costs are often found in areas with higher property values and taxes, such as New York and California, while lower costs are typically found in regions with more affordable housing markets.

Breakdown of Costs: Typical closing costs include the loan origination fee (0-1% of the loan amount), discount points (optional fees to lower the mortgage interest rate), and various processing and underwriting fees. Additionally, you will encounter third-party fees like the appraisal fee ($500-$1,000), title search and insurance fees ($300-$2,500), and escrow fees ($350-$1,000).

Estimating Your Costs: To get a more accurate estimate of your closing costs, you can use online calculators provided by mortgage lenders and real estate websites. These tools allow you to input specific details about your loan and property to generate a customized estimate of your expected closing costs. Additionally, your lender will provide a Loan Estimate document after you apply for a mortgage, which outlines your projected closing costs.

How Can You Estimate Your Closing Costs Accurately?

Accurately estimating your closing costs is essential for effective budgeting during the home-buying process. Several tools and resources can help you achieve this:

Loan Estimate Document: When you apply for a mortgage, your lender will provide a Loan Estimate document within three business days. This document outlines your estimated closing costs, including lender fees, third-party fees, and prepaid items. Reviewing and comparing Loan Estimates from different lenders can help you find the most favorable terms and understand the expected costs.

Online Closing Cost Calculators: Various online tools, such as those offered by NerdWallet and SoFi, allow you to input specific details about your loan and property to generate a customized estimate of your closing costs. These calculators take into account factors like loan amount, property value, and location to provide a more accurate estimate.

Consulting Real Estate Professionals: Engaging with a local real estate agent or mortgage lender can provide personalized insights based on your specific circumstances and local market conditions. These professionals can help you navigate the complexities of closing costs and ensure you are well-prepared financially.

What Should You Look for in the Loan Estimate Document?

The Loan Estimate document is a critical tool for understanding your potential closing costs and ensuring transparency in the mortgage process. Here are key sections to review:

Loan Terms: This section provides an overview of the loan amount, interest rate, and monthly principal and interest payments. It also indicates whether the interest rate is fixed or adjustable and if there are any prepayment penalties or balloon payments.

Projected Payments: Here, you can see the estimated total monthly payment, including principal, interest, mortgage insurance, and escrow amounts for property taxes and homeowners insurance. This section helps you understand your long-term financial commitment.

Closing Cost Details: The Loan Estimate includes a detailed breakdown of estimated closing costs. This consists of lender fees, such as origination and underwriting fees, third-party fees like appraisal and title insurance costs, and prepaid items. Reviewing these details allows you to compare offers from different lenders and identify areas where you might negotiate or save.

Understanding and reviewing the Loan Estimate document thoroughly can help you avoid surprises at closing and ensure you make informed decisions during the home-buying process.

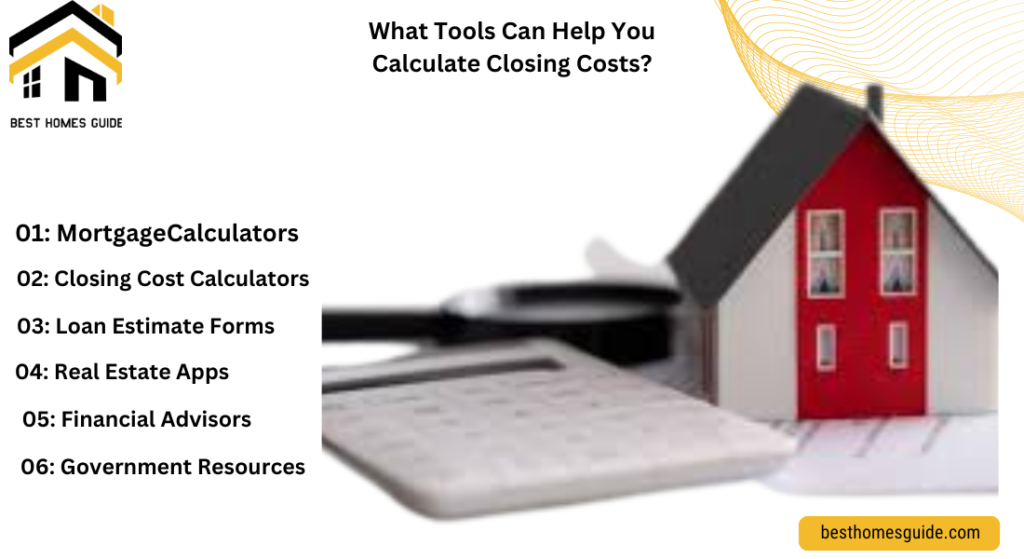

What Tools Can Help You Calculate Closing Costs?

Estimating closing costs accurately is crucial for budgeting and financial planning when buying a home. Several tools and resources can help you calculate these costs and ensure you are prepared for the financial requirements at closing.

Loan Estimate Document: After applying for a mortgage, your lender is required to provide a Loan Estimate document within three business days. This document outlines the estimated closing costs, including lender fees, third-party fees, and prepaid items. Comparing Loan Estimates from different lenders can help you find the best deal and negotiate lower fees.

Closing Cost Calculators: Online closing cost calculators are valuable tools that allow you to input specific details about your loan and property to generate a customized estimate of your closing costs. Websites like NerdWallet and SoFi offer these calculators, helping you to anticipate expenses and budget accordingly.

Real Estate Agents and Lenders: Consulting with a local real estate agent or your lender can provide personalized estimates based on your specific situation and the local market conditions. These professionals have the experience and knowledge to give you a more accurate picture of what to expect in terms of closing costs.

What Are Some Common Mistakes to Avoid with Closing Costs?

Navigating closing costs can be tricky, and avoiding common mistakes can save you money and stress.

Overlooking the Loan Estimate: Many buyers fail to thoroughly review the Loan Estimate provided at the start of the mortgage process. This document outlines your expected closing costs and loan terms, serving as a benchmark for comparison with the Closing Disclosure. Ensure you understand all the fees listed and ask your lender about any unclear charges.

Not Shopping Around: It’s essential to compare closing costs from different lenders. Fees can vary significantly, and shopping around can help you find the best deal. Use online calculators and tools to compare costs and negotiate with lenders for better rates and lower fees.

Ignoring Title Insurance: Title insurance protects against potential legal claims on your property. While it’s an additional cost, neglecting this can lead to significant expenses down the line if issues arise. Ensure you understand the difference between lender’s and owner’s title insurance and consider purchasing both for full protection.

How Can You Prepare Financially for Closing Costs?

Preparing for closing costs involves several key steps to ensure you are financially ready for this significant expense.

Budget Early: Start by estimating your closing costs early in the home buying process. Use online tools and calculators to get a rough idea of what you’ll need to save. Remember that closing costs typically range from 2% to 6% of the loan amount, so plan accordingly.

Review and Save: Thoroughly review your Loan Estimate and Closing Disclosure documents. These will provide a detailed breakdown of all costs involved. Save diligently to cover these expenses and consider setting aside an extra buffer to cover any unexpected costs that might arise during the process.

Seek Professional Advice: Work with your real estate agent, lender, and possibly a financial advisor to understand all potential costs. They can provide insights and advice tailored to your situation, helping you prepare for closing day with confidence.

By understanding and preparing for closing costs, you can navigate the home buying process more smoothly and avoid financial surprises.

How Do Property Taxes Impact Your Closing Costs?

Property taxes are a significant part of your closing costs and can vary widely based on the location and value of the property. Understanding how these taxes are calculated and their impact on your overall closing costs is essential.

Escrow Accounts: At closing, lenders often require an initial deposit into an escrow account to cover future property tax payments. This initial deposit can range from two to nine months’ worth of property taxes, depending on the time of year and local tax billing cycles. The lender then collects monthly payments as part of your mortgage to ensure property taxes are paid on time.

Prepaid Property Taxes: Depending on the closing date, you may need to prepay a portion of the property taxes. For example, if property taxes are due shortly after closing, the lender may require you to pay these taxes upfront to ensure there are no delinquencies. This prepayment is included in your closing costs and can vary based on local tax rates and the timing of the transaction.

Impact on Total Costs: Property taxes can significantly increase your total closing costs, especially in areas with high tax rates. It’s essential to factor these taxes into your budget and use tools like closing cost calculators to estimate the overall impact. Being prepared for these expenses will help you avoid any surprises at closing and ensure a smoother home buying process.

By understanding the various components of closing costs, including lender fees, tools for estimation, and the impact of property taxes, you can navigate the home buying process with greater confidence and financial preparedness.

What Is the Role of Title Insurance in Closing Costs?

Title insurance plays a crucial role in ensuring a smooth and secure real estate transaction. It protects both buyers and lenders from potential financial loss due to defects in the property title. These defects could include issues like undisclosed heirs, forgery, or existing liens that were not discovered during the initial title search.

Types of Title Insurance: Two main types of title Insurance policies: lender’s and owner’s policies: The lender’s policy is typically required by mortgage lenders and protects their interest in the property. This policy covers the loan amount and is usually a condition for approving the mortgage. The owner’s policy, on the other hand, is optional but highly recommended as it protects the buyer’s equity in the property for as long as they or their heirs own it.

Cost of Title Insurance: The cost of title insurance varies but generally ranges from 0.5% to 1% of the home’s purchase price. For instance, on a $400,000 home, you might pay between $2,000 and $4,000 for the lender’s title insurance. The owner’s title insurance is an additional cost, typically ranging from a few hundred to a couple of thousand dollars depending on the property’s value and location. These costs are usually included in the closing costs and are a one-time premium, providing long-term protection.

How Does the Closing Disclosure Summarize Your Closing Costs?

The Closing Disclosure is a critical document in the home buying process, providing a detailed account of your mortgage loan terms and all associated costs. This five-page document is given to you at least three business days before closing, ensuring you have ample time to review and confirm the details.

Overview and Key Sections:

- Page 1: This page offers a snapshot of your loan, including the loan amount, interest rate, monthly payments, and total closing costs. It also outlines whether there are prepayment penalties or balloon payments, giving you a clear view of your financial obligations at a glance.

- Page 2: you’ll find an itemized breakdown of all closing costs. This includes loan costs such as origination fees and application fees, and other expenses like appraisal fees and title insurance. This section distinguishes between costs the buyer and seller are responsible for, and any lender credits.

- Page 3: This page compares the final loan terms and costs to the initial Loan Estimate. It’s crucial for identifying any significant changes. It also shows seller credits and any adjustments for pre-paid expenses.

- Page 4: This section details loan disclosures, including information on late payments, partial payments, and the presence of an escrow account. It helps you understand the terms if you miss a payment and the management of your escrow account.

- Page 5: The final page summarizes the total costs of the loan over its term and includes additional disclosures such as liability in foreclosure and required appraisal copy provision. It also provides contact information for your lender.

What Happens if You Don’t Have Enough Money to Cover Closing Costs?

Facing a shortage of funds to cover closing costs can be a significant hurdle in the home-buying process. However, there are several strategies and solutions to consider if you find yourself in this situation.

1. Financing Options: Many lenders offer options to help borrowers who cannot cover closing costs upfront. One popular solution is rolling the closing costs into the mortgage, known as a no-closing-cost mortgage. While this increases the loan amount and, consequently, the monthly payments, it allows you to pay the closing costs over time rather than upfront. Another option is to negotiate a lender credit, where you accept a slightly higher interest rate in exchange for the lender covering some or all of the closing costs.

2. Assistance Programs: Various assistance programs are available to help cover closing costs. Many state and local housing agencies, often in partnership with HUD, offer grants or low-interest loans to first-time homebuyers and low-to-moderate income borrowers. These programs can significantly reduce the financial burden at closing. It’s advisable to apply for these programs early in the home-buying process, as funds can be limited and the application process may take time.

3. Negotiation and Savings: Negotiating with the seller to cover a portion of the closing costs can also be effective, especially in a buyer’s market where sellers are more motivated. Additionally, saving more money before purchasing a home can provide a buffer to cover these expenses. Delaying your home purchase by a few months to save additional funds can make a significant difference.

How Do Closing Costs Differ for Refinancing Versus Purchasing a Home?

Closing costs for refinancing a home and purchasing a new home have some similarities, but there are also distinct differences.

- Similarities: Both scenarios involve lender fees, appraisal fees, and title insurance costs. You will need to cover these fees regardless of whether you are buying a new home or refinancing an existing mortgage. These costs typically range from 2% to 6% of the loan amount.

- Differences: When refinancing, some costs may be lower or waived altogether. For example, title insurance costs might be reduced because the property has already been insured, and some lenders may offer streamlined refinancing options that reduce the need for a full appraisal or other fees. Additionally, when purchasing a new home, you may incur additional costs such as home inspection fees, which are typically not required in a refinancing transaction.

- Cost Management: Refinancing offers opportunities to roll closing costs into the new loan, spreading the cost over the life of the loan. While this increases the total amount paid over time, it can reduce the immediate financial burden. It’s essential to weigh these options carefully and consider the long-term implications on your mortgage payments and overall financial health.

How Do Closing Costs Impact the Real Estate Market?

Closing costs play a significant role in the dynamics of the real estate market. These expenses, which include loan origination fees, appraisal fees, and title insurance, can influence buyer behavior and affect property pricing. High closing costs may deter potential buyers, leading to slower market activity and potentially lower property prices. Conversely, competitive closing costs can attract more buyers, boosting market activity and supporting stable or rising property values. Understanding these costs is crucial for both buyers and sellers to make informed decisions and navigate the market effectively.

The impact of closing costs extends beyond individual transactions, shaping broader market trends. For instance, in a market with generally high closing costs, sellers might need to lower their asking prices to accommodate buyer budgets, affecting overall market pricing trends. On the other hand, in a market with lower average closing costs, more buyers might be willing to enter the market, driving demand and potentially increasing property prices.